401k 2024 Contribution Limit Irs Employer Match

401k 2024 Contribution Limit Irs Employer Match. How to cash out a 401k matched by a previous employer (2024), for simple retirement accounts, the 2024 limit is. 401(k) contribution limits and employer match for 2024.

Contributions from all sources—including employer 401(k) matching—are limited to $66,000. 2024 401(k)/403(b)/401(a) total contribution limit the total of all employee and employer contributions per employer will increase from $66,000 in 2023 to $69,000 in 2024 for.

The Irs Allows An Individual To Contribute Up To $23,000 To Their 401(K) Plan In 2024, A Slight Increase From The Previous Year’s Limit Of.

Get your employer 401(k) match.

This Affects Employees 50 Years Of Age Or Older Participating In Plans.

Total defined contribution limit (employee and employer contributions):

Contributions From All Sources—Including Employer 401(K) Matching—Are Limited To $66,000.

Images References :

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2023 Meld Financial, Workplace retirement plan contribution limits for 2024 for those with a 401(k), 403(b), or 457 plan through an employer, your new maximum contribution limit will go up to. The irs has released the 401(k) contribution limits for the year 2024.

Source: www.betterup.com

Source: www.betterup.com

What 401(k) Employer Match Is and How It Works in 2023, For young workers, a notable change. The irs has released the 401(k) contribution limits for the year 2024.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS just announced the 2022 401(k) and IRA contribution limits, The limit on employer and employee contributions is $69,000. For 2024, the 401(k) employee salary deferral limit has been raised to $23,000.

matching example_ Boeing.png?width=3720&name=401(k) matching example_ Boeing.png) Source: www.betterup.com

Source: www.betterup.com

What 401(k) Employer Match Is and How It Works in 2023, For 2024, the 401(k) limit for employee salary deferrals is $23,000, which is above the 401(k) 2023 limit of $22,500. For tax year 2023 (filed by april 2024), the contribution limit is $22,500.

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, However, you and your employer may. For every $1 you contribute to the 401 (k), your employer will contribute another $.50.

Source: dodyqkimberlyn.pages.dev

Source: dodyqkimberlyn.pages.dev

401k Employer Match Limit 2024 Terza Michal, For every $1 you contribute to the 401 (k), your employer will contribute another $.50. The irs allows an individual to contribute up to $23,000 to their 401(k) plan in 2024, a slight increase from the previous year’s limit of.

Source: www.sensefinancial.com

Source: www.sensefinancial.com

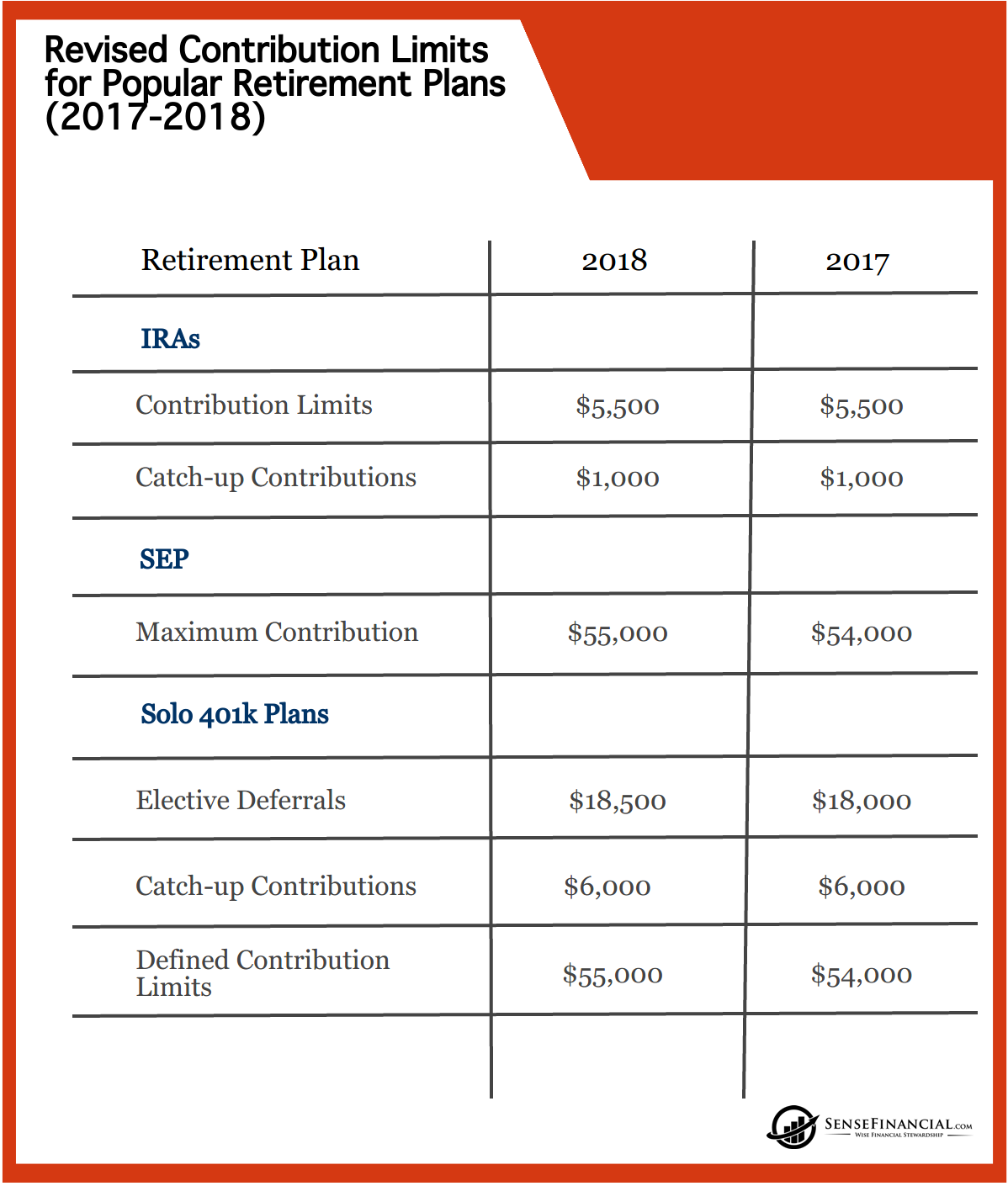

Infographics IRS Announces Revised Contribution Limits for 401(k), Limits on contributions and benefits. Workplace retirement plan contribution limits for 2024 for those with a 401(k), 403(b), or 457 plan through an employer, your new maximum contribution limit will go up to.

Source: moneymonarchs.com

Source: moneymonarchs.com

Guide to 401(k) Contribution Limits and Employer Match for 2024, Employer matches don’t count toward this limit and can be quite generous. For 2024, the 401(k) employee salary deferral limit has been raised to $23,000.

Source: insights.wjohnsonassociates.com

Source: insights.wjohnsonassociates.com

401(k) Contribution Limits & How to Max Out the BP Employee Savings, Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up to $23,000 in 2024, a $500 increase. Employer matches don’t count toward this limit and can be quite generous.

Source: www.zenefits.com

Source: www.zenefits.com

The Big List of 401k FAQs for 2020 Workest, The 401(k) contribution limit for 2024 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions. These limits impact the amount you can contribute.

Get Your Employer 401(K) Match.

The irs has released the 401(k) contribution limits for the year 2024.

However, You And Your Employer May.

These limits impact the amount you can contribute.